What is Zero-Based Budgeting in Personal Finance?

Zero-based budgeting, also known as ZBB, is one of many budgeting methods in personal finance. The process is pretty simple: list your income and divide that between your expenses and goals.

In this article, we’ll discuss:

Why should I use Zero-Based Budgeting?

Before we dive deep into the details of the process, let me first tell you about the benefits of zero-based budgeting:

You avoid overspending

The term "zero-based budgeting" was coined because when using this method, you start with zero every month. Then, you list down your expected income and plan how you'll use that. Because of this, you don't spend more than what you earn. So long as you stick to your plan, you avoid overspending and touching your savings.

You achieve more of your life goals

This is my favorite reason why you should use zero-based budgeting. ZBB requires you to plan ahead of time. Because of this, you get to decide how much of your income will be spent on expenses and how much will be saved.

I understand that some expenses have little flexibility, such as daily necessities, utilities, and rent. But if you have extra money after paying the bills, you can choose to use that, whether it's for debt payment, for a business idea, or maybe for a family trip.

You decide which life goal takes the highest priority, may it be early retirement, buying a home, or having kids.

You get to be flexible with your budget

Zero-based budgeting is a very flexible budgeting method. You can change it every month or choose to keep it the same.

As we know, the only thing constant in life is change. And so, when our circumstances change, ZBB allows our budget to change with us. We aren't restricted by rules, like "30% of your income must always go to savings."

It can vary from person to person, from situation to situation.

For example, this month, you experience a health emergency. So, you use up your emergency fund. Next month, you can temporarily prioritize refilling your emergency fund instead of funding your travel goal.

Another example would be if your monthly income suddenly decreases. In this case, your budget for last month will be very different from next month's. You might not be able to add as much to your savings as before. You might even need to withdraw from your savings. And that's okay.

Zero-based budgeting understands that sometimes, life happens.

You spend less time organizing your finances

Zero-based budgeting doesn’t require you to track your daily expenses. Daily expense tracking means you’re trying to figure out where your money went. But the zero-based budgeting method requires you to plan ahead instead. This means you’re telling your money where to go.

Admittedly, you will need to spend some time planning your budget before your income arrives. However, it gets easier after that. You don’t need to collect receipts anymore, nor try to remember your transactions from two weeks ago. Say good bye to daily expense tracking. Hello, financial freedom!

You know whether you should buy something or not

Before I learned about ZBB, I almost always asked myself, "Should I buy this? Do I need it? Do I have the budget for it? What budget?"

In zero-based budgeting, you also get to plan your expenses. We're not just talking about your usual bills: utilities, rent, and food. ZBB also allows you to add a fun fund, which you can spend however you like. And if you don't use it all this month, you can carry it over to the next month.

Now, whenever I want to buy something that's not in the budget, I check my fun fund. If there's enough money for it, then it's a yes. Let's buy it!

Don't get me wrong; I still go through the cycle of asking myself, "Do I really need this? Is this the best deal I can get? Does this spark joy?" the way my Asian ancestors and Marie Kondo have taught me. But the overthinking has definitely lessened, considering I now accurately know when my budget allows it or not.

You can spend guilt-free while still saving money

Do you ever feel guilty after going on a shopping spree? Or for giving in to the temptation of buying a new PlayStation? Or for taking some time off to go on an out-of-town trip?

For someone who loves to save money, I used to feel this all the time. I felt like I couldn't enjoy my salary because I knew I had to save for retirement. But retirement is decades away for me. Surely, there must be a way for me to enjoy my hard-earned money without waiting decades...

Zero-based budgeting enabled me to spend guilt-free while still saving money. Now, I note in my budget how much I plan to add to my retirement fund. I also specify how much I'll spend on each category, whether for rent, eating out, or self-care. This way, if I want to buy a new skincare product, it's included in the budget.

If I want to buy something expensive, like the latest iPhone, I set a savings goal first. I include this goal in my budget, which keeps me consistently saving money for it. Once the goal is complete, I can buy what I want when I want, guilt-free. The feeling of guilt is gone because the money spent is money I saved for this specific purpose.

You can instantly tell how much you've spent in a particular expense category

Previously, after every out-of-town trip, I would spend hours figuring out how much the trip cost me. Honestly, hours. Then, add the stress of trying to remember transactions because not all expenses come with a receipt. (Also, I may have thrown some of them.) It gets crazy.

But with zero-based budgeting, I now immediately know how much my trip costs. Here's how:

I plan ahead of time how much I'll spend on a trip.

I move that amount to another savings account, which I only use whenever I travel.

After the trip, I can simply look at my account balance and see how much remains.

From that, I can calculate how much I've spent.

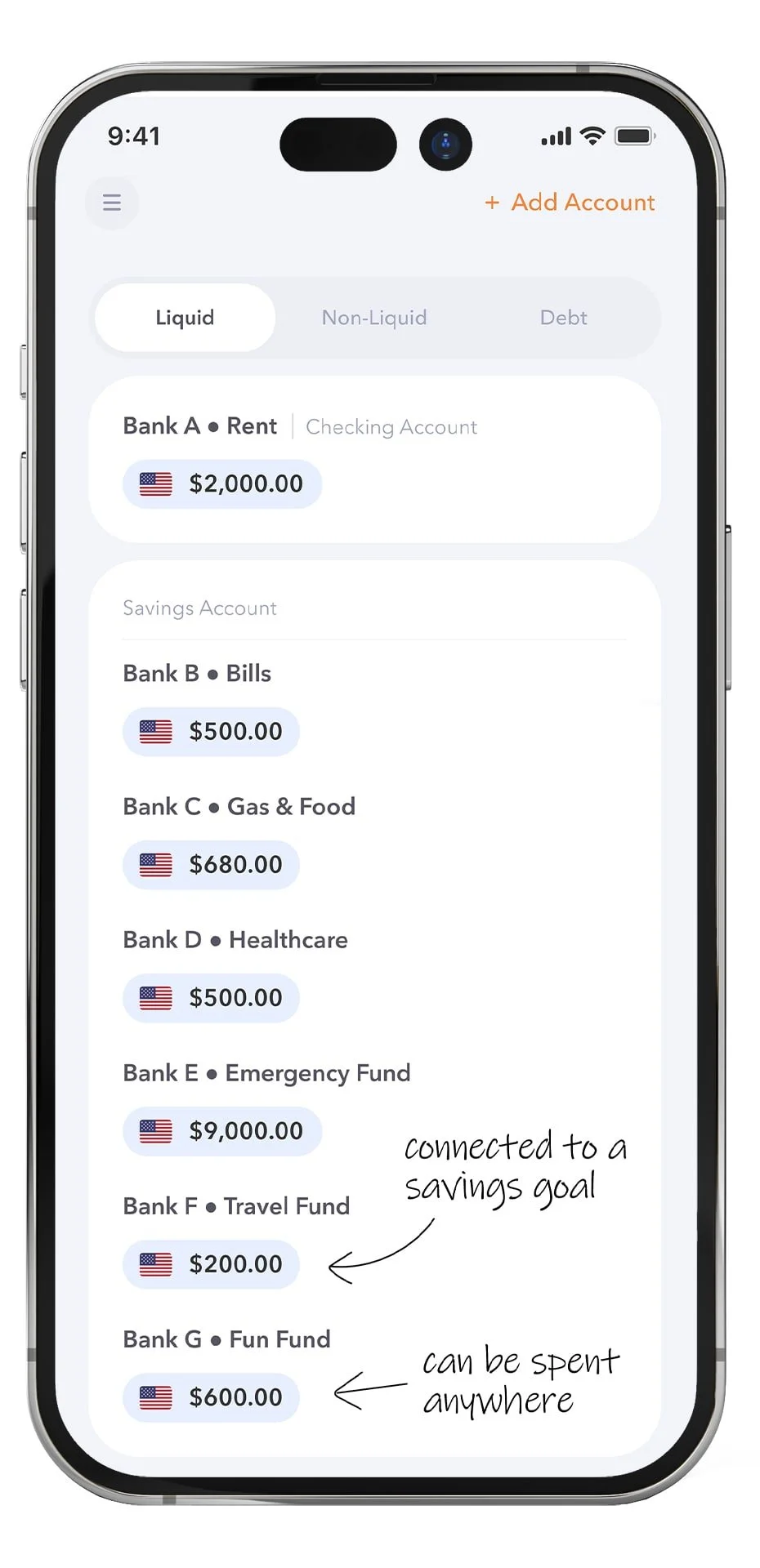

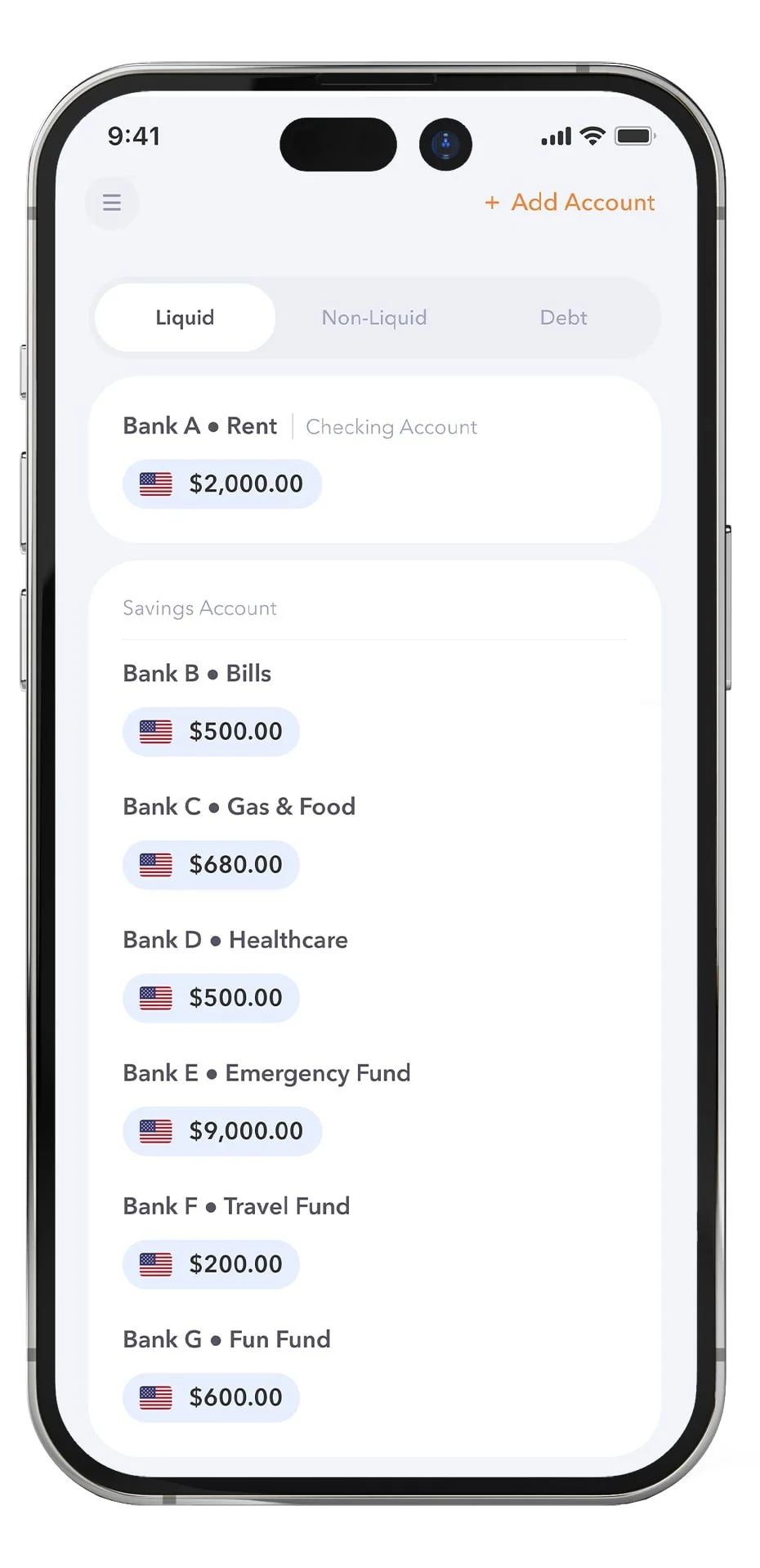

It's super easy and stress-free compared to before. This method can be applied to other expense categories, so long as I've separated my money accordingly. For context, here's how I currently separate my money:

How do I make a zero-based budget?

You probably have an idea by now how zero-based budgeting works for personal finance. Here's a step-by-step guide to help you get started:

List down your income

Make a plan

Follow your plan

List down your income

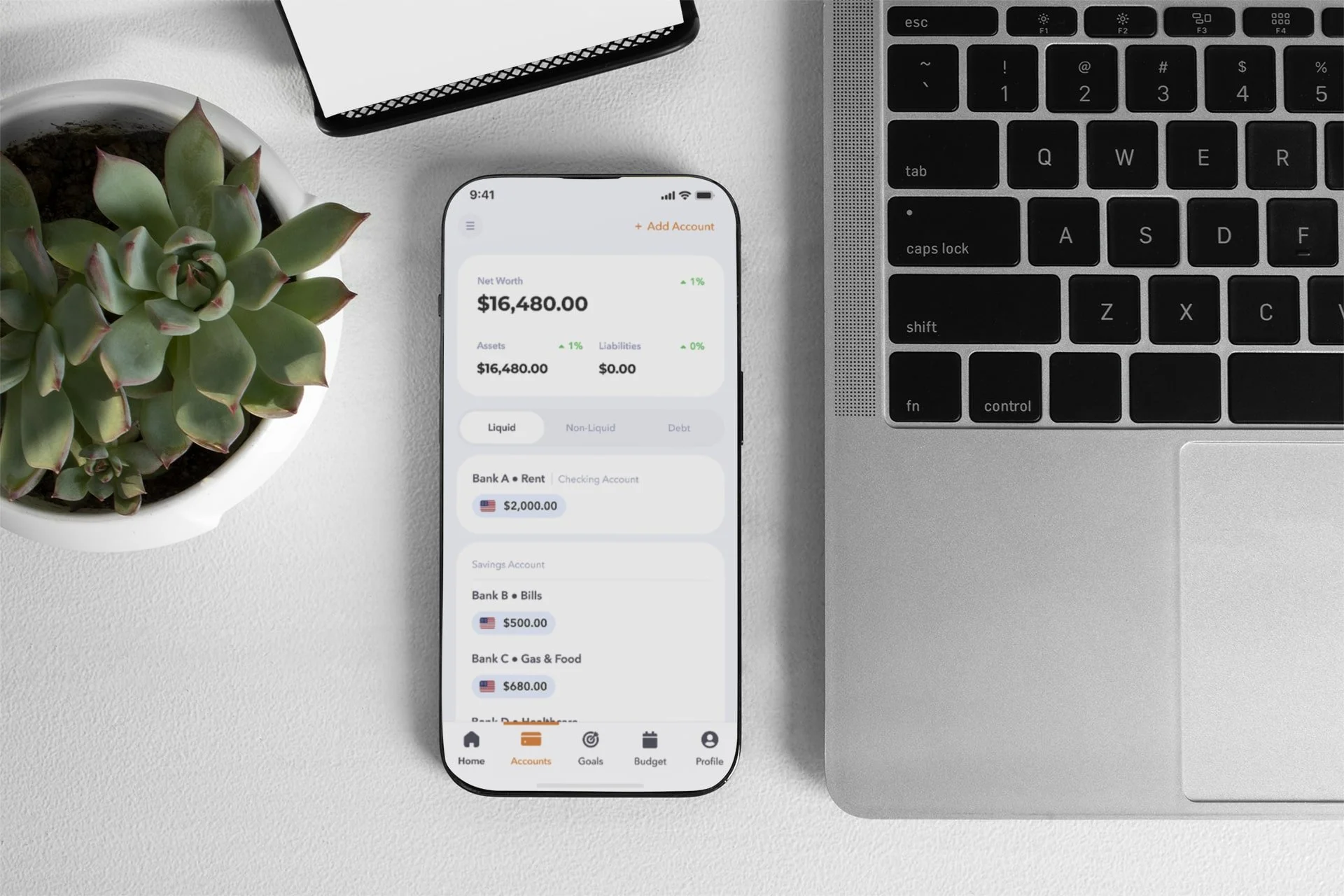

You'll find the first step of zero-based budgeting easy if you've got a fixed monthly salary. You can write down your income in a notebook, type it in Excel, or use the app of your choice. We recommend using the Build My Wealth app for zero-based budgeting.

If you receive your income twice a month, note the amounts and the dates when you receive them. Do this before or at the beginning of the month.

If you have a variable income, similar to that of a freelancer or a business owner, estimate your expected monthly income. You can check how much your average monthly income was last year and then adjust the amount depending on your situation this year.

Make a plan

The second step of zero-based budgeting is to plan what you'll do with your income. Here are your options:

Increase savings

Save for a specific goal

Pay off debt

Pay bills

Here's how I plan my budget using the Build My Wealth app:

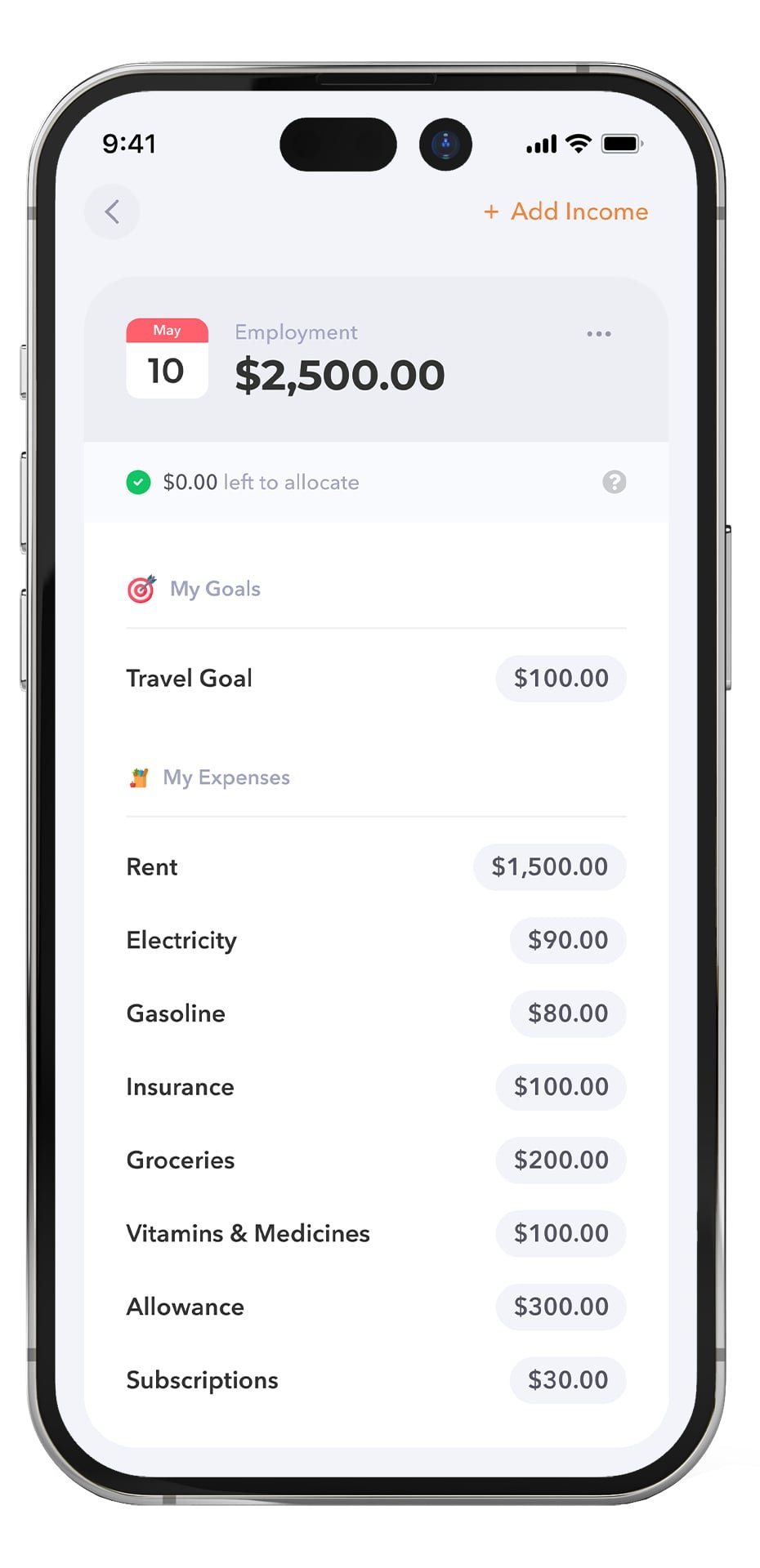

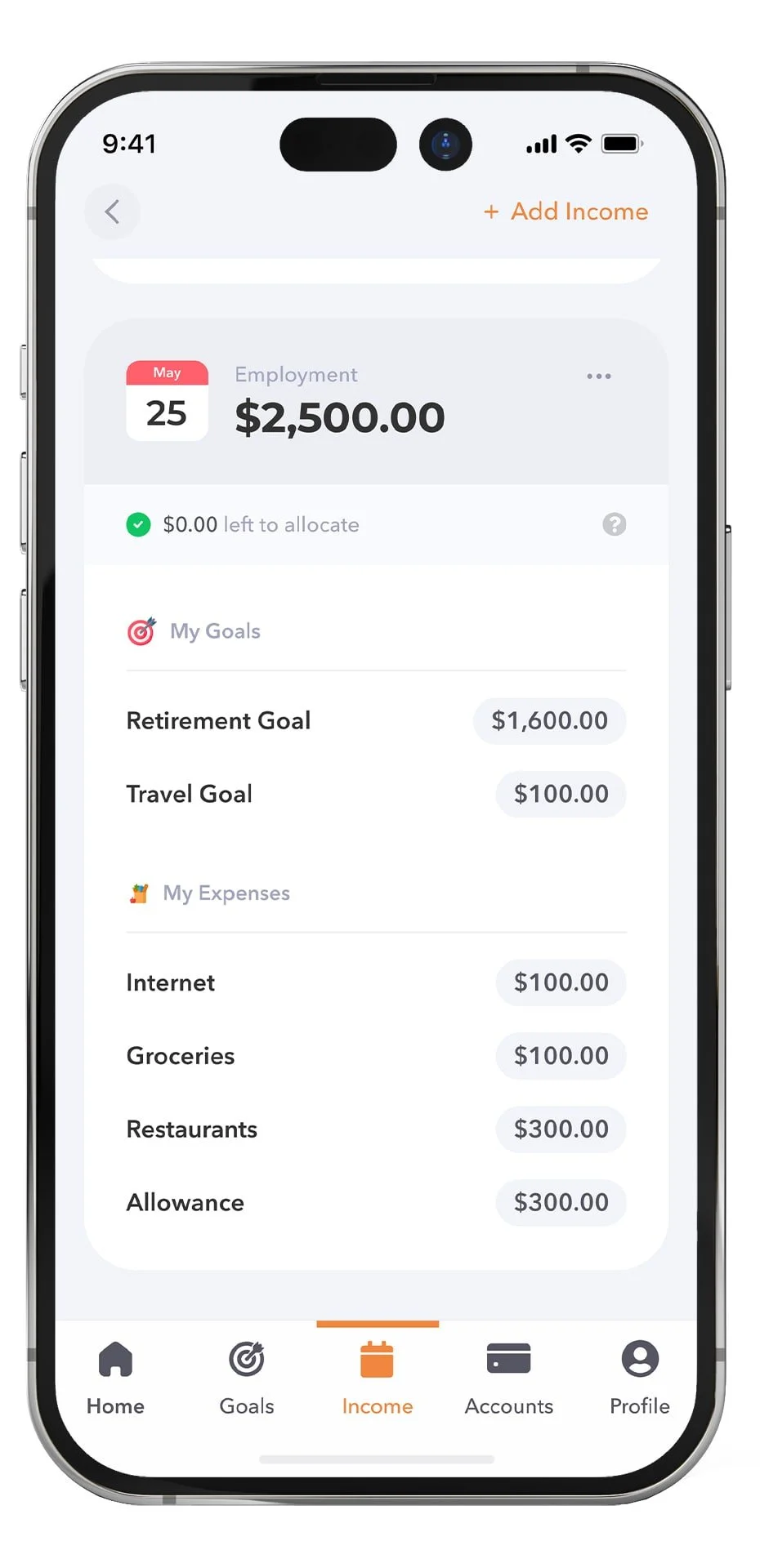

There are two income entries because I get paid twice a month

We all pay bills according to their due date. That's how I decide which expenses are assigned to which income entry.

I make sure my budget allows me to spend on fun things. I use the Allowance category for my Fun Fund. I can spend that money on whatever I want; because remember, we work to live. We don't live to work.

Aside from my retirement goal, I have another savings goal that's included in my budget.

As mentioned earlier, zero-based budgeting is a flexible budgeting method. Your budget will probably be different from the screenshots above. Your daily responsibilities are different from mine. Our jobs are different. Our ideal lifestyles and priorities are different. So adjust accordingly.

Take the plan to the next level

Congrats! You've made a budget plan! You now know how you'll divide your income between savings and expenses once it arrives.

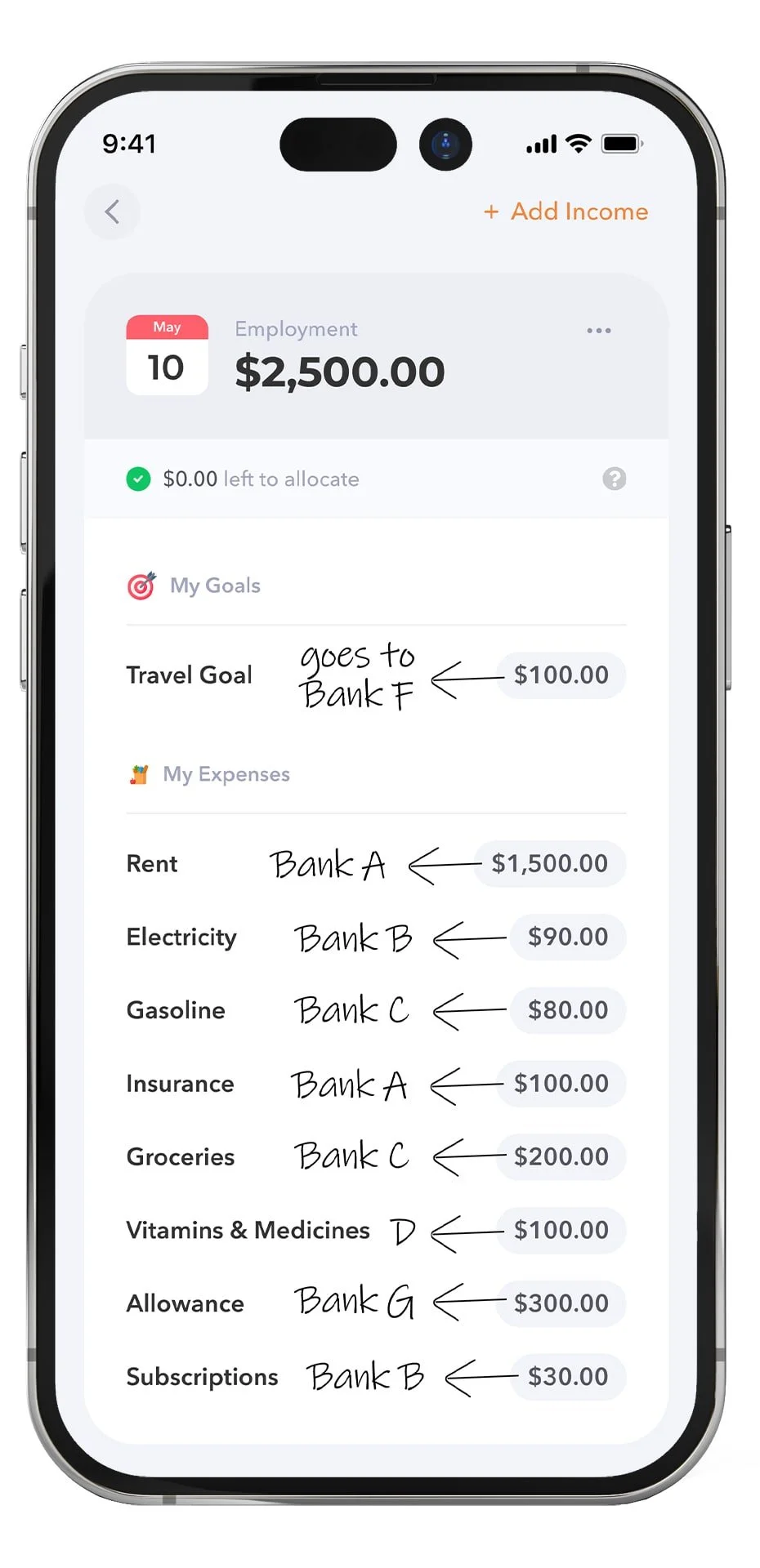

Here's an additional tip to keep you organized: Plan how you'll actually divide your money in real life.

Your first option is to withdraw your money. Then, divide the cash according to your budget plan and put it into separate envelopes. This method is called the cash envelope system.

Your second option is to have separate bank accounts for different spending purposes. Include this in your plan so that once your income arrives, you immediately know how much money to transfer to which bank account. Here's an example:

Notes on where each amount will get transferred to

A list of my accounts for reference

Follow your plan

Once your income arrives, simply do what you've planned. Either divide the cash into separate envelopes or divide the money by transferring it to different bank accounts. Afterwards, pay your bills. Remember to get the funds from the right envelope or account.

In zero-based budgeting, do I need to track my daily expenses?

No. The beauty of zero-based budgeting is that you're not reacting to where your money went. Instead, you're taking control and telling it where to go.

Hence, there's no need to track your daily expenses because you already know how much you'll spend for each expense category. You already know how much of your salary you'll save and how close you are to your goals.

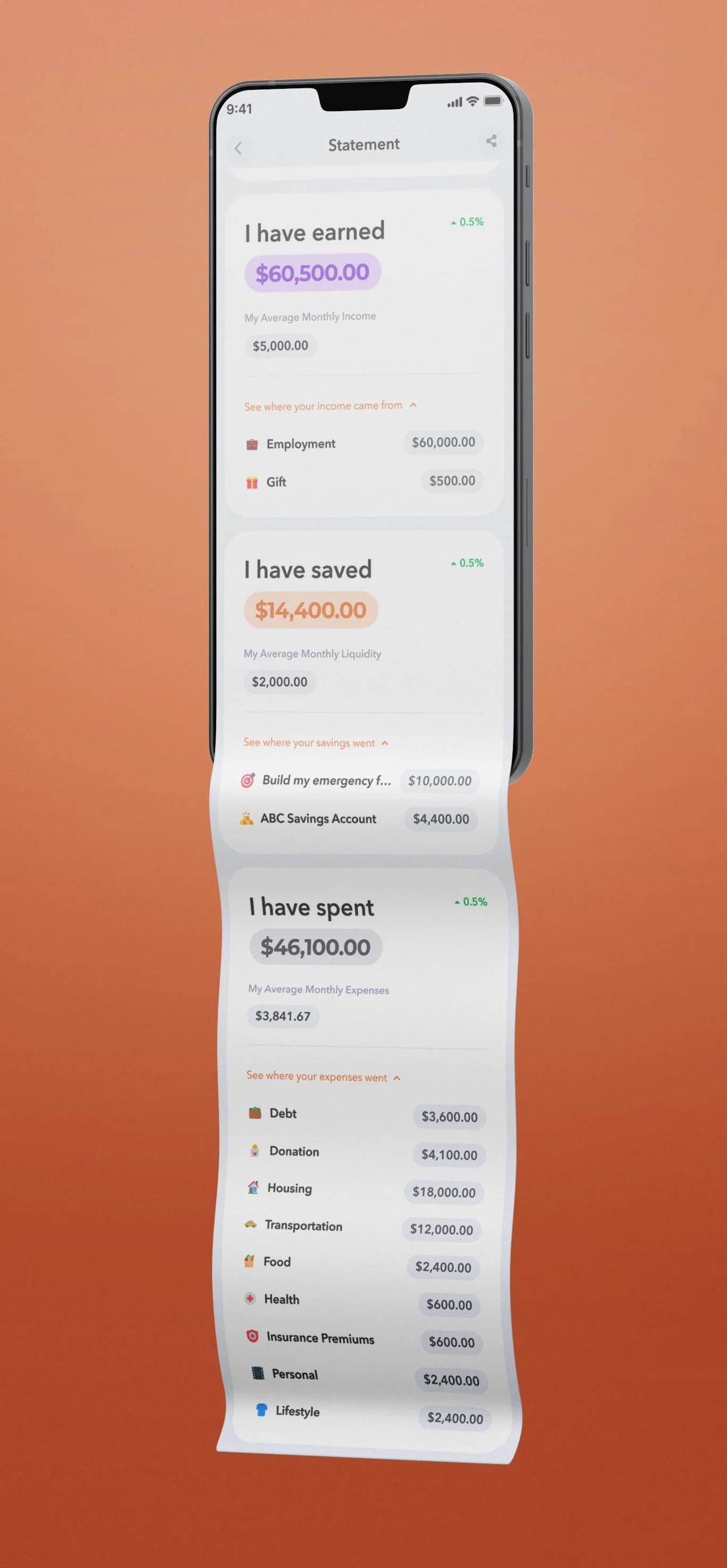

If you want an annual overview of your expenses, you can use the Build My Wealth app for at least a month and generate a cash flow statement similar to the one below:

How do I know if my spending is still within my budget?

Check your account balance. It’s that simple.

If you're doing the cash envelope system, check how much money remains in each envelope.

If you're using several bank accounts, check the balance of each. We recommend you register for online banking to make this step easier.

Some review their account balances every two weeks. Some prefer to do it once a month. You can use the Accounts tab in the Build My Wealth app to keep track of all your balances.

What if I need to spend for an emergency that's not in my budget?

Sometimes, life happens. And it happens to all of us. So if you don't have an emergency fund yet, we highly suggest you prioritize saving for one.

An emergency fund is usually 3-6 months worth of expenses. If you can save for 12 months of expenses, the better. This way, you'll survive for a year if you lose your job.

You can tap your emergency fund in case of job loss, health emergencies, home repairs, and other situations where you urgently need money.

If it's not an emergency, create a separate savings goal. And don't spend before completing that goal.